The Government of Dominica has provided the Dominica Agricultural & Industrial Bank (AID Bank) a sum of 27.8 million dollars to lend to micro, small and medium enterprises (MSMEs).

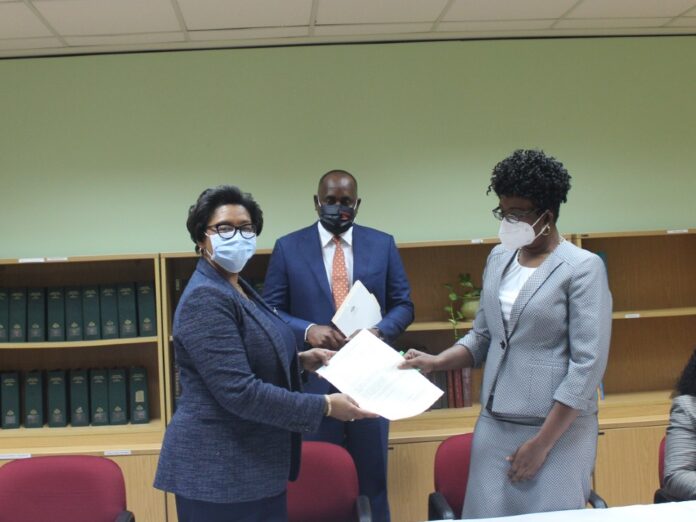

The agreement was signed today with the AID Bank and Prime Minister Roosevelt Skerrit who is also the Minister of Finance says this holds much promise for many people, who will be able to access financing to facilitate investments in business and enterprise and the creation of jobs and new income streams.

“The agreement is in respect of a promise I made to the micro, small and medium enterprises (the MSMEs) in the Fiscal Year 2020/2021 Budget and today this promise is manifested. As I have always said, despite the unforeseen, and regular, economic shocks we contend with as a country, this Government always keeps its promises,” Skerrit said.

“We are happy that we are able to fulfill our promise notwithstanding the Government’s less than optimal fiscal position due to the impact of the COVID 19 pandemic. Since March 2020, Government has had increased expenditure related to COVID management and response while revenues have remained below 2019 levels. Yet, here we are, putting systems in place to give our citizens a push; the boost they need to get back on their feet, improve their living conditions and build their small enterprises.”

He said that the Dominica Labour Party Government has “heard the cry of small business owners across the country for access to concessionary financing—as a result of the difficulties they have encountered to procure loans from the commercial banks, and as is often the case, the high-interest rates attached to these loans.”

Further, Skerrit stated, small businesses have taken “a disproportionately hard hit due to the ongoing pandemic.”

“We hear the call for assistance to bring their enterprises back to previous operational strength, to expand, and to prepare for the anticipated post-pandemic bounce back in the economy.”

“In response, the Government has loaned (EC$27.8m) from the Caribbean Development Bank (CDB) for on-lending to the MSMEs through the AID Bank. These will be offered at an interest rate of three and a half percent (3.5%) per annum on the reducing balance. Borrowers will be given a grace period of six (6) months on the payment of the principal and interest and a ten-year repayment term,” the Dominica Finance Minister stated.

He explained that this special facility builds on previous investments made by the Government in Micro, Small, and Medium Enterprises (MSMEs). “This is not our first intervention to assist business owners impacted by the pandemic. In September 2021, this Government placed an amount of six million ($6m) at the AID Bank to lend to micro and small businesses. This complemented an initial five million ($5m), which was made available by the Government as a COVID response measure in 2020,” he said.

To date he said, the total amount made available by his government, since May 2020 (a period of fewer than two years), for lending to MSMEs on very concessional terms, is $39.4 million.

All of this he remarked was in addition to the grants that Government continues to provide through the Small Business Unit within the Ministry of Tourism; the $1million recently pledged to the Dominica Youth Business Trust, and the human resource support provided through the National Employment Programme.

“Due to our support of the small business sector over the past years, small and medium-sized enterprises have fulfilled an even greater role in the economic and social development of our country. Presently, we are seeing the rise of small businesses in Dominica. More of our young people are taking up entrepreneurship and displaying a high level of creativity and innovation. “

“They are developing their interests in information technology, pursuing employment and money-making opportunities online, and creating businesses, which operate within the digital space. Others are involved in small-scale manufacturing, cosmetology, and retail. This facility provides an avenue for them to invest and expand their enterprises, create employment and contribute to growth in the economy.”

According to Skerrit, his government understands the importance of the contribution of the micro, small and medium enterprises to the Dominican economy. “I speak here of the agro-processors, the plumbers, electricians, farmers, fishermen, vendors, barbers, hairdressers, retailers, artists-and all the other entrepreneurs who ensure that economic activity remains steady. We believe the injection of funds into this sector will positively impact small business activity and touch the lives of the common man in every village, in every part of Dominica,” He remarked.

He encouraged business owners who qualify, to take this opportunity to grow their businesses in a sustainable manner. Stating that the funds were secured specifically for them, to help spur growth in the small business sector.

He warned, however, that government will closely monitor the pace and efficiency of the disbursements at the AID Bank. “I have already informed the Bank that these funds must get to every corner of the country during this calendar year. This is about people. It is about enhancing lives and livelihoods and we must make every effort to ensure our people, who are in need of the funds, benefit in the quickest possible time,” he said.

“I am encouraged by the growth prospects for the local economy. The IMF and other international financial institutions, including the ECCB, are projecting average growth of up to five percent this year and over the next 3 to 5 years. These predictions are supported by the investments we are making to build the digital economy and develop the geothermal plant to transform the energy sector. The construction of new hotels and the international airport; direct flights from the US mainland; extensive investments in agriculture; and increasing export opportunities, all position us to realize gradual growth over the next new few years.”

This access to financing he said, falls in line with the growth trajectory that Dominica is currently pursuing. “It means that you as a small or medium-sized business owner can be part of our thrust to bolster the economy and contribute to the sustainable development of this country. I invite you, as a people and country, to embrace this opportunity. Let us, together, continue to build a Resilient, Dynamic Dominica,” Skerrit stated.